Bringing AI-Powered Communication to Life: How an AI Humanizing Tool Helps You Humanize AI Text

Technology is not everything and is not more important than the voice in digital communication. With innovation and storytelling colliding, it is critical to transform AI-generated content and make it warm and engaging. AI has the ability to produce data-driven scripts, articles, or updates quickly and precisely. What however is often mislaid is human warmth. That is where the tool to humanize AI text comes in, turning the robotic wording into the real one, which can be associated with.

This is a technical advancement and a creative development that is a bridge between automation and authentic expression. It enables technology-driven companies to reach individuals personally, conveying complicated concepts with simplicity, style and soul.

Why AI Humanizing Tool is Important in Tech & Comms?

As far as technology and communications are concerned, how you say it is as important as what you say. There should be clarity, rhythm and feeling in every line of what your readers or listeners expect. This is more likely to be so even when the subject is very technical. AI devices can generate text, but to create text that is readable, it requires a guide. Otherwise, it will sound like it is text generated by, say, a computer.

As far as technology and communications are concerned, how you say it is as important as what you say. There should be clarity, rhythm and feeling in every line of what your readers or listeners expect. This is more likely to be so even when the subject is very technical. AI devices can generate text, but to create text that is readable, it requires a guide. Otherwise, it will sound like it is text generated by, say, a computer.

The reason why humanizing AI-generated language is so important is as follows:

1-Readers and listeners want to hear or read something easy to understand.

No one would like to read a manual. Blogs and podcast scripts share the same trait, readings that sound more like a discussion rather than a lecture.

2-Requires simplicity and friendliness.

Communicating the new communication technologies, such as 5G networks to nanotech radio systems, cannot be explained only with accuracy. It requires parallels, comparisons, and real-life illustrations to cause ideas to resonate.

3-Automated scripting is hazardous to feel isolated.

AI text may lack the human touch, which makes it sound sterile, technical, but flat. In a brand that lives off innovation and interaction, this move may drive away the people that you are attempting to reach.

What AI Humanizing Tool Offers?

An AI humanizing tool does not rewrite words only, but retells the tone, rhythm, and emotion in a manner that makes your message empathized. It is comparable to a storytelling coach to AI. It works this way by changing your communication:

1-Makes technical language easy to understand.

The heavy jargon descriptions are also divided into natural and friendly sounding expressions. The result? Easy to read, easy to understand content.

2-Increases rhetorical questions or analogies in order to promote connection.

The tool brings human touches as opposed to cold statements. These minor details cause grand differences in interaction.

3-Adjusts the flow of text to either spoken or readable.

The humanizing process goes to make your message seem balanced and easy to follow, be it when listened or read.

You can also read posts about “Technology and Communications” to learn more on this topic. It supports the same mission, rendering technical contents easy to read and interesting.

Conclusion

Humanizing AI text means to add personality and clarity to digital communication. It changes structured and mechanical writing to one that directly addresses people. They can be reading about the latest technology or hearing a podcast about communication trends. As AI makes tools more human, any article, post, or broadcast can be not only smart but also alive.

Social media used to be a megaphone—loud, one-way, and mostly about pushing out content. But things have shifted. Today, platforms like Instagram are less about shouting and more about connecting. For brands, it’s no longer enough to post pretty pictures and clever captions. The real challenge is building relationships. To achieve this, many businesses are integrating Instagram with their customer relationship management (CRM) systems—not just to organize data, but to personalize interactions and boost Instagram followers by creating deeper, more relevant connections.

Social media used to be a megaphone—loud, one-way, and mostly about pushing out content. But things have shifted. Today, platforms like Instagram are less about shouting and more about connecting. For brands, it’s no longer enough to post pretty pictures and clever captions. The real challenge is building relationships. To achieve this, many businesses are integrating Instagram with their customer relationship management (CRM) systems—not just to organize data, but to personalize interactions and boost Instagram followers by creating deeper, more relevant connections. Data is everywhere, but data alone isn’t enough. It’s what you do with that data that matters. That’s where SAP Analytics Cloud (SAC) comes in. It’s a tool designed to help businesses transform raw data into actionable insights—and ultimately, make better decisions.

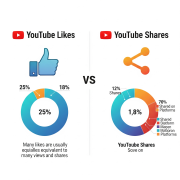

Data is everywhere, but data alone isn’t enough. It’s what you do with that data that matters. That’s where SAP Analytics Cloud (SAC) comes in. It’s a tool designed to help businesses transform raw data into actionable insights—and ultimately, make better decisions. Engagement tokens are likes. Easy, quick, and a symbol of approval, that’s what they are. A large number of likes increases the video’s discoverability and makes it more likely that algorithms will recommend it to users.

Engagement tokens are likes. Easy, quick, and a symbol of approval, that’s what they are. A large number of likes increases the video’s discoverability and makes it more likely that algorithms will recommend it to users. The gaming world has grown fast, and so have the tools that shape how we play. Technology and communication platforms now play a big role, especially in tactical games. One major area this shows up in is Tarkov cheats. While some players use cheats for fun or shortcuts, others see them as a threat to fair play.

The gaming world has grown fast, and so have the tools that shape how we play. Technology and communication platforms now play a big role, especially in tactical games. One major area this shows up in is Tarkov cheats. While some players use cheats for fun or shortcuts, others see them as a threat to fair play. Reddit has long prided itself on being “the front page of the internet.” But behind the upvotes, downvotes, and subreddits lies a complex and often opaque moderation system. At the center of that system is a controversial practice: the shadowban. Unlike an outright ban, a shadowban is designed to be invisible to the user. You can still post, comment, and vote—but no one else sees your activity. It’s a form of quiet censorship, and on Reddit, it’s driven largely by automation and algorithms. Tools like rupvote can help users check if they’ve been shadowbanned without their knowledge.

Reddit has long prided itself on being “the front page of the internet.” But behind the upvotes, downvotes, and subreddits lies a complex and often opaque moderation system. At the center of that system is a controversial practice: the shadowban. Unlike an outright ban, a shadowban is designed to be invisible to the user. You can still post, comment, and vote—but no one else sees your activity. It’s a form of quiet censorship, and on Reddit, it’s driven largely by automation and algorithms. Tools like rupvote can help users check if they’ve been shadowbanned without their knowledge. Online shoppers expect seamless, secure interactions with their favorite brands. eCommerce businesses face immense pressure to deliver reliable communication channels that keep customers engaged and protected. From order confirmations to personalized offers, every touchpoint matters. Yet, cyber threats, system downtimes, and high-traffic surges can disrupt these connections, risking revenue and reputation. How can businesses ensure uninterrupted, trustworthy communication? The answer lies in robust strategies that prioritize platform stability, proactive monitoring, and brand integrity.

Online shoppers expect seamless, secure interactions with their favorite brands. eCommerce businesses face immense pressure to deliver reliable communication channels that keep customers engaged and protected. From order confirmations to personalized offers, every touchpoint matters. Yet, cyber threats, system downtimes, and high-traffic surges can disrupt these connections, risking revenue and reputation. How can businesses ensure uninterrupted, trustworthy communication? The answer lies in robust strategies that prioritize platform stability, proactive monitoring, and brand integrity.

The towing industry, once reliant on basic mechanical tools and manual coordination, is undergoing a significant transformation. Modern technology is reshaping how tow trucks operate, making them smarter, more efficient, and more reliable. Key advancements include

The towing industry, once reliant on basic mechanical tools and manual coordination, is undergoing a significant transformation. Modern technology is reshaping how tow trucks operate, making them smarter, more efficient, and more reliable. Key advancements include

The definition of IPTV is simple, yet its implications are profound. By utilizing the internet to deliver television services, IPTV services facilitate a level of convenience and customization unattainable through conventional methods. The power to choose what to watch and when to watch it has placed control back into the hands of the viewer, establishing a new norm in consumption: video-on-demand. Agile IPTV business models anticipate viewer preferences, allowing for seamless streaming services on a plethora of devices from smart TVs to smartphones.

The definition of IPTV is simple, yet its implications are profound. By utilizing the internet to deliver television services, IPTV services facilitate a level of convenience and customization unattainable through conventional methods. The power to choose what to watch and when to watch it has placed control back into the hands of the viewer, establishing a new norm in consumption: video-on-demand. Agile IPTV business models anticipate viewer preferences, allowing for seamless streaming services on a plethora of devices from smart TVs to smartphones. When it comes to technical requirements, a steady high-speed internet connection is your lifeline to quality IPTV streaming. For uninterrupted live streaming, aim for internet speeds of at least 25 Mbps, and ensure your hardware—from Android TV boxes to Amazon Fire TV Stick—supports your chosen IPTV platform. As you delve deeper into the specifics, compare the critical aspects such as the diversity of VOD available, the ability to support multiple connections, and the inclusion of a fully-functional electronic program guide (EPG) that enhances your viewing experience.

When it comes to technical requirements, a steady high-speed internet connection is your lifeline to quality IPTV streaming. For uninterrupted live streaming, aim for internet speeds of at least 25 Mbps, and ensure your hardware—from Android TV boxes to Amazon Fire TV Stick—supports your chosen IPTV platform. As you delve deeper into the specifics, compare the critical aspects such as the diversity of VOD available, the ability to support multiple connections, and the inclusion of a fully-functional electronic program guide (EPG) that enhances your viewing experience.

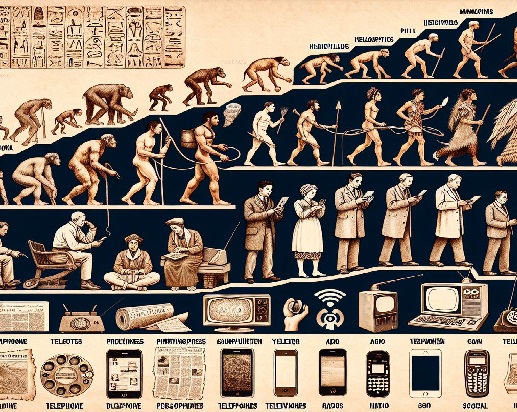

In the rapidly evolving landscape of modern business, the confluence of technology, communication, and example of tacit knowledge has become a focal point for companies striving for efficiency and innovation.

In the rapidly evolving landscape of modern business, the confluence of technology, communication, and example of tacit knowledge has become a focal point for companies striving for efficiency and innovation.

On their own and unprotected as a human character made from blocks, a player’s first line of protection is a shelter that can shield him against monsters and mobsters that come out at night. Yet one has to first make the necessary tools to use for building.

On their own and unprotected as a human character made from blocks, a player’s first line of protection is a shelter that can shield him against monsters and mobsters that come out at night. Yet one has to first make the necessary tools to use for building. New players need to have a stronger protection if they want to progress in the game. Always keep in mind that the key mindset that will allow you to stay long and further in the game is your survival instinct and your knack for improvising tools you can use for building.

New players need to have a stronger protection if they want to progress in the game. Always keep in mind that the key mindset that will allow you to stay long and further in the game is your survival instinct and your knack for improvising tools you can use for building.